This is ambiguous; hence, if you wish to be unambiguous the use of M to mean either thousands or millions is to be avoided. Thus, we’re left with k and MM as to unambiguous ways to denote thousands and millions respectively. However, I often see where those who are dealing with financing (banks and investment houses for bonds) use the MM for millions of dollars. If K and MM are used, it’s bad style because the symbols are being mixed up.

For example, a thousand is often abbreviated as (M), a million is abbreviated as (MM), and a billion is abbreviated as (BN) or (MMM). One thing to consider is that when writing about large amounts of money, the words “million” or “billion” are often left out altogether, as are superfluous zeroes. It’s then up to the reader to note the context, with the document stating the place value once at the beginning and not again. Unfortunately, there isn’t a consistent approach to labeling units. The least ambiguous approach is to simply write them out in words, such as “$ thousands.” This is CFI’s recommended method, to avoid any potential confusion. The problem with M is that depending on the audience it can mean either thousands or millions.

Access Exclusive Templates

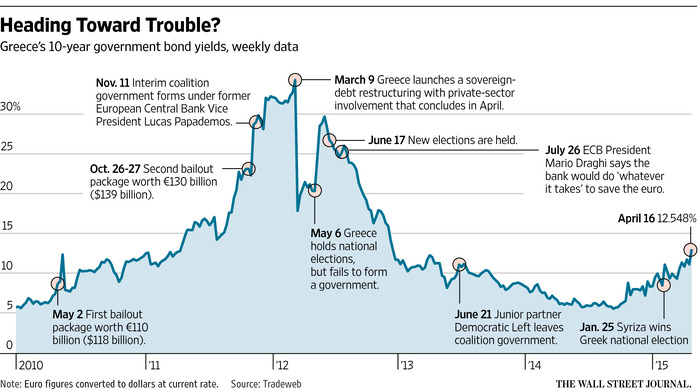

Company A generated total revenue of $450,000,000 last year. The cost of goods sold was $300,000,000, and the operating expenses were $80,000,000. When plural, as in “millions,” it refers to multiples of 1,000,000. In its simplest terms, a million is “one thousand thousand”.

The word “million” is most often used in reference to money, but is also frequently used in exaggeration. The word “million” can be paired with the suffix “-aire” to form the word millionaire which indicates an individual with a million or more dollars. “M” is the only acceptable abbreviation to use for “million” in UK English. You’ll find that a lot of UK native speakers won’t even know what “mm” stands for (outside of the “millimeter” measurement that is abbreviated to “mm”).

Mixing use of K for thousands and MM for millions

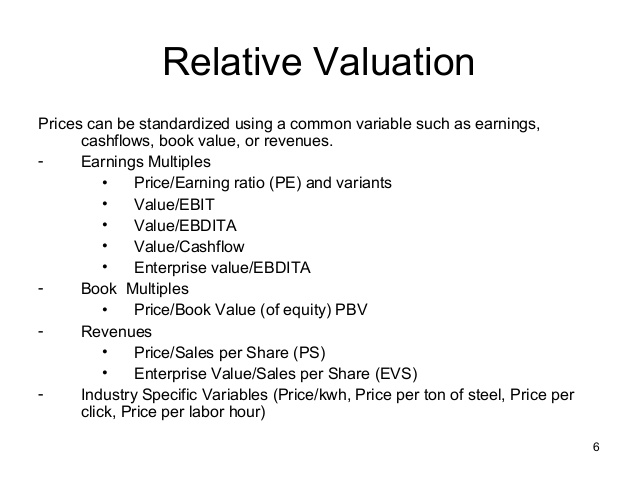

Review a few examples of sentences that feature common abbreviations for million. While the letter “k” is the most common abbreviation, there are a few different ways to abbreviate thousand. In numerical expressions, “MM” stands for millions (equivalent to 1,000,000), “K” represents thousands (equal to 1,000), and “B” represents billions (equivalent to 1,000,000,000). So if you work at a European bank you’ll probably be using the former.

- In oil and gas, m is used for thousands and mm is for millions.

- It is Latin for multiplying one “thousand” by itself to create the “million” number.

- Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

- Generally, you will not come across a “million” of anything.

Personally I hate that notation and use capital M whenever given the opportunity. I feel like it used to show superiority or present another barrier to people outside of finance looking in. “M” is the official abbreviation used whenever a million units of something are requested. Internet advertisers are familiar with CPM which is the cost per thousand impressions.

Words Related to Moon

It is Latin for multiplying one “thousand” by itself to create the “million” number. “MM” is an old-fashioned abbreviation, but it still sees some usage today. You might come across “mm” in scientific or engineering fields, where different values are required, and they can reach well into the millions as a unit.

In this article, we will teach you how to abbreviate the word and how to use the abbreviation for “million.” Let’s first understand what million means. In this example, we intentionally chose a piece of analysis that contained various different units, such as dollars and shares. When an analyst must present various different types of units, it is recommended to add a “units” column so that each item contains a label for easy reference. Territory includes Washington, Oregon, Montana, Idaho, Hawaii, Alaska, California, and Utah. Darrel has over 30 years of proven success and is skilled in developing relationships with internal and external stakeholders to drive superior business results.

However, it’s fairly uncommon for “Million” to be abbreviated outside of scientific circles. Most native speakers wouldn’t care much about “million” as an abbreviation because they won’t often come across the number in their daily lives. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. The use of two m’s to denote millions is becoming less common.

Frequently, in finance and accounting settings now, an analyst will use k to denote thousands and a capitalized M to denote millions. Traditionally, M is used as the symbol for thousands and MM for millions in the business world, particularly in accounting. However, there has been a growing tendency to use K as the symbol for thousands instead of M.

Example Sentences With Billion Abbreviations

This practice was across the board – exam reports, internal reporting, and so on. Now that you know several large number abbreviations, you have access to several options you can use in your reports or other forms of writing. You may also find it helpful to review measurement abbreviations for common units. Expand your ability to communicate about quantities and amounts by getting to know various names and expressions for large numbers. A global tech company, Tech&Tech, reported total revenue of $800,000,000 for the fiscal year 2021. Calculate the company’s net profit margin and express it in MM.

Companies tackle menopause stigma with #HotResignation campaign – MM+M Online

Companies tackle menopause stigma with #HotResignation campaign.

Posted: Wed, 02 Aug 2023 20:20:57 GMT [source]

Can’t explain why, but I’ve just gotten used to it at this point. As stated above, MM is generally used in business to represent millions since the letter M by itself has historically meant 1,000. That said, if your organization uses M and it doesn’t cause confusion, you are free to use M to abbreviate one million. Regardless of why you are trying to abbreviate the word “million,” you have come to the right place.

Let us convert the data into a notation of millions for a clear and concise representation. The WSO investment banking interview course is designed by countless professionals with real world experience, tailored to people aspiring to break into the industry. This guide will help you learn how to answer these questions and many, many more. For example, within financial statements, the industry-standard abbreviation is M for a thousand, while in everyday life, the abbreviation of K for a thousand is usually the acceptable one. Therefore, discretion must be applied within every situation to accurately implement the acceptable abbreviation or comprehend the abbreviation you are reviewing. Within finance and accounting, we often find something quite different.

This numerical system has the digits 0, 1, 2, 3, 4, 5, 6, 7, 8, 9. It was first created in India, and from there, it progressively spread to Arabia and China. If 1,000 multiplied by 1,000 equals 1,000,000, and 1,000 equals M, then we can use the abbreviations to create calculations. You can also use the abbreviation “mil” in casual conversation. You might hear something along the lines of “He dropped a couple mil on a new car,” or perhaps “How many mils is that house? ” This abbreviation works for both spoken and written dialogue, and is easily recognizable.

- Within finance and accounting, we often find something quite different.

- Review a few examples of sentences that feature common abbreviations for million.

- The Latin numeral MM is frequently used to designate that the units used in presenting information (financial and non-financial) are in millions.

- Now that you know several large number abbreviations, you have access to several options you can use in your reports or other forms of writing.

- This numerical system has the digits 0, 1, 2, 3, 4, 5, 6, 7, 8, 9.

- As one discovers from the many variant opinions this topic generates significant misunderstanding.

Each firm will have a different preference and you should abide by what your firm’s rule is. If you are working on a project independently you should simply pick one format and stick with it as consistency is what matters. Who the hell would confuse $m as referring to anything other than millions. Because we have multiple options to choose from when selecting an abbreviation, it is important to use context to make the proper selection. The Hindu – Arabic numeral system is what we have used ever since.

If you see an abbreviation that is confusing or unclear, please reach out to your local underwriter or branch for clarification, even if you are just asking for a friend. I have had the same dilemma and come to the conclusion that using k for thousands and MM for millions is a reasonable and pragmatic thing to do. Connect and share knowledge within a single location that is structured and easy to search. To add to the potential for misunderstanding, MM is not the Roman numeral for million. There are a few different ways to abbreviate billion, most are similar to the million abbreviations.

By Industry

To summarize, our modern numerical system is the same as the Hindu-Arabic numerical system. However, our abbreviations are a concoction of multiple cultural legacies ranging from Rome, Greece, India, China, and Arabia. The numerical transformation post 13th century in Europe is largely credited to Leonardo of Pisa, also known as Fibonacci. At Old Republic Surety we seek to deliver transparency and clarity in our communications.

Breakingviews – Post-it maker 3M is in danger of coming unstuck – Reuters

Breakingviews – Post-it maker 3M is in danger of coming unstuck.

Posted: Wed, 19 Jul 2023 07:00:00 GMT [source]

Whether the topic is significant sums of money or a massive quantity of something, it’s common to use abbreviations when writing out large numbers in text. Some abbreviations for million options may surprise you, as is also true for some of the other large number abbreviations. You m mm million shouldn’t use abbreviations in academic or official writing. Use abbreviations in informal scenarios like notes and unimportant communication where context exists. “mm” is often left uncapitalized (though there are no specific rules that state which way it should be written).

You might not put a lot of thought into your abbreviations, and that’s okay. However, there are official abbreviations out there that you might come across, and it would help to know about them. We’ll explain the correct abbreviation for “million” in this article. A small-scale clothes manufacturing company, Weavers & Co., records the following data in its income statement.