We strongly advise traders to consult our checklist before choosing a Canadian forex broker that offers high-quality online trading services. CIBC Investor’s Edge offers the lowest commissions out of the major banks, with the exception of National Bank’s commission-free trading. Stock and ETF trades with CIBC Investor’s Edge only cost $6.95 per trade, a discount to the usual $9.95 at other banks, while option trades cost $6.95 plus $1.25 per contract. Just like the other banks, only Canadian and U.S. equities and options are offered.

An unlicensed broker is a red flag because they may close up shop at any moment and run away with your money. If the broker is a Canadian-based broker, ensure they are licensed by the IIROC. Foreign brokers should be licensed by at least two or more regulatory agencies. The more licenses they hold, the more they can be trusted.

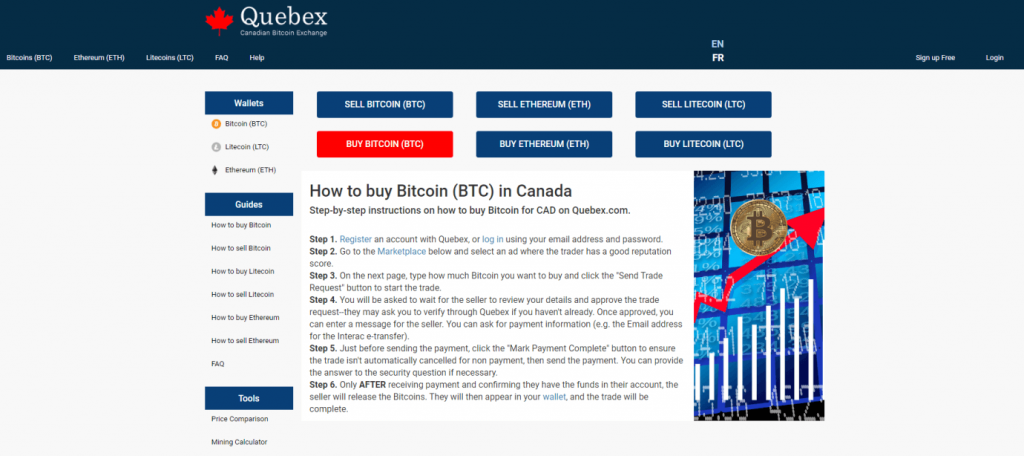

Local Canadian brokers

The Forex trading industry is expanding at a rapid pace and more Canadian day traders are seeking to join the Forex markets. One of the main reasons for the increase in Forex trading is that investors can trade anywhere in the world at any given time. Unlike stocks that are listed on specific markets with closing hours, Forex currency pairs can be traded 24/7. Most brokers, including Avatrade, do not charge any commission. The broker’s remuneration comes from the spread, the difference between the buying price and the selling price of a currency pair at an instant T. The spread applied to your favorite currency pairs is therefore a key element in the choice of an online broker.

Forex trading in Canada is legal and regulated by government agencies. This means that trading in foreign currencies within Canada is not an illegal activity. The government agency responsible for regulating the forex market in Canada is the Investment Industry Regulatory Organization of Canada (IIROC).

Best Micro Accounts

Before you pitch your tent with a Forex broker in Canada, you also need to investigate its trade execution. Find out if the broker fills you at the best price possible for each order. The broker needs to fill you in at the best price possible each time you buy or sell. It is important to register with a broker offering low transaction costs.

- At the same time, you must not overlook the reliability of the broker.

- These days it is rare for an online broker to limit himself to forex.

- The reason for this is the huge economy of the United States.

- This is to say that different Forex Brokers Canada offer different numbers of currency pairs.

Currently, interest rates in Canada are at all-time lows, which might lead one to believe that the value of our dollar would also be low. However, the Canadian dollar has risen substantially against the US dollar over the past year, partly because interest rates are also low south of the border. Aside from those, a broker should not have any excuse not to process your trade very fast. Even if the broker does not execute that trade at the desired price, the execution price must be very close to what you desire.

Avoid these blacklisted brokers

Fluctuation in the values of currencies can negatively affect companies that do their businesses in foreign countries. This effect comes up when the companies buy or sell their goods and services outside their domestic markets. The Forex market makes it possible to hedge risks in currency exchange. They do this by fixing the rate at which the completion of the transaction occurs. The exchange plays the role of a counterpart to the futures trader.

Weekly Forex Forecast – NASDAQ 100 Index, USD/JPY, GBP/USD – DailyForex.com

Weekly Forex Forecast – NASDAQ 100 Index, USD/JPY, GBP/USD.

Posted: Sun, 04 Jun 2023 07:00:00 GMT [source]

For active accounts, some brokers accept deposits of $5 or $10, while others demand more to top up your trading account. When picking a forex broker to open an account, you have to consider many factors. You may choose a broker based in Canada or a foreign broker; however, their location doesn’t matter.

Enjoy FX spreads from 0.0 pips

It is overseen by multiple European regulatory bodies, ensuring a secure and safe environment for Forex trading. XTB is one of the largest Forex and CFD brokers in the world with nearly 20 years of experience and offices in 13 countries. Like the other brokers listed here, XTB prides itself on providing advanced trading technology and good customer service while also relying heavily on trust.

Best Forex Brokers in Canada – Finance Magnates

Best Forex Brokers in Canada.

Posted: Tue, 06 Dec 2022 08:00:00 GMT [source]

You’re probably bewildered by such little technicalities, but don’t worry; we’ve got you covered. Contracts for difference (CFD) trading is a popular form of leveraged trading that allows you to go long or short on thousands of global markets, and hedge a physical portfolio. If you are transferring money internationally or receiving money from overseas, we can help you save money as well because of our better exchange rates. When you perfect your strategy, you can switch to real trading with a live account.

You should make sure that the broker is reliable before you register there. A change that may cause a rise or fall in the values of currencies against another brings about an opportunity to make a profit. The speculator looks to profit from the increase or decrease in the value of a currency pair. When you buy one of the currencies in the pair, it means you are selling the other currency in the pair and vice versa.

Since FXCM charges a flat commission per forex trade, it has very low currency spreads. As an example, the spread on EUR/USD can be as low as 0.2 pips. CMC Markets takes the top spot on my list as a great forex platform for most Canadian traders that are looking to trade foreign currencies.

Proprietary trading platforms have special features that are not common to MT4 or MT5 platforms. The conditions of trading on a proprietary trading platform can also differ from what obtains on MT4 or MT5. Before you choose the particular trading platform to use, first check the prevailing conditions. Go for one that offers the best trading conditions among them.

If you are selling a currency pair, it means that you are selling the base currency and buying the quote currency. When trading Forex, the trader is always going long on one currency and going short on the other. Forex traders who trade with unlicensed brokers do so at their own risk, and many have been victims https://forex-reviews.org/ of fraud. These bodies, in conjunction with the IIROC, regulate trading and ensure that trader funds are safe and secure. They also ensure that registered brokers within their jurisdiction play by the rules. This is why only licensed brokers are allowed to operate within the online space of Canada.

Given that the price of gold and crude oil directly affects the value of the CAD, forex traders should pay close attention to these prices. An ECN Forex broker is an online Forex intermediary that specializes in the use of electronic communication networks (ECNs). The Forex ECN broker gives account holders and traders access to other currency markets that they normally wouldn’t have access to, thus increasing the opportunities for trades. Online brokerages let you trade a wide variety of equities, ETFs, mutual funds and more with your trading account.

Anytime there is an excess of either one, it can cause foreign currency prices to fluctuate in either direction. It involves, among other things, controlling the supply of money as a means of sustaining the growth of the economy at a reasonable rate. Limiting the money supply can cause the price of a currency to rise while printing more money can have the opposite effect.