The sales of 10,000 made in cash shall be recorded on the credit side of a Trading A/c of the entity. Apple Inc is a laptop and computer dealer, and it sold goods to Kevin Electronics on January 1, 2018, worth $50,000 on credit. It means John Electronics must make the payment on or before January 30, 2018. Let’s look at the journal entries for Printing Plus and post each of those entries to their respective T-accounts. Another key element to understanding the general ledger, and the third step in the accounting cycle, is how to calculate balances in ledger accounts. Accounts receivable account is credited when money is received on a later date.

What Are Accounts Uncollectible, Example – Investopedia

What Are Accounts Uncollectible, Example.

Posted: Sun, 26 Mar 2017 05:10:04 GMT [source]

At the same time, the inventory on the balance sheet will be reduced as a result of goods sold. Grocery stores of all sizes must purchase product and track inventory. While the number of entries might differ, the recording process does not.

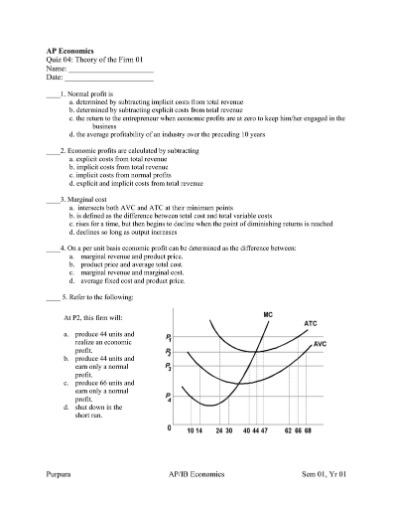

Calculating Account Balances

The job cost record also documents costs of the work-in-process inventory, the finished goods inventory, and the cost of goods sold, serving as a subsidiary ledger. When products are sold, the asset account of accounts receivable is debited to show an increase, and Sales, a revenue account, is credited in the same amount to inventory days formula show an increase. This means that when we purchase the inventory goods in, we need to record it as an increase in the inventory account immediately. The purchases account in this journal entry is a temporary account that will be cleared at the end of the accounting period when we prepare the income statement for the period.

And the total amount of goods purchased will be included as an addition in the calculation of the cost of goods sold (COGS). You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side.

What is the Journal Entry for Credit Sales and Cash Sales?

As direct materials are requested, the materials are released from the raw materials inventory and attached to the job. Direct labor is recorded by employees who are assigned to the job. When the job is completed, overhead is allocated to the job at a predetermined rate. Alternatively, if we use the perpetual inventory system, we can debit the inventory account and credit the cash account for the purchase of goods in cash journal entry. This journal entry will increase both total assets and total liabilities on the balance sheet by $10,000 for purchasing the $10,000 goods on credit. Gather information from your books before recording your COGS journal entries.

- The transaction, goods sold for cash, has an effect on both sides of the accounting equation.

- When the job is completed, overhead is allocated to the job at a predetermined rate.

- The journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory.

- Inventory sold on credit is the business transaction the company delivers inventory to customers first and collects cash later.

In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle. There’s a 5% sales tax rate, meaning you receive $25 in sales tax ($500 X 0.05).

Journal entry for goods sold for cash

The beginning inventory balance will be the total of the inventory asset accounts in the general ledger. Purchased inventory costs may be included in the inventory assets accounts, or they may be in a separate purchases account. Ending inventory will require a physical count unless a perpetual inventory system is used. Calculating the cost of ending inventory can become complicated, as it is dependent on the costing system used.

Lio is a revolutionary software product designed to simplify and streaming your business processes. With Lio, you can bid farewell to the headaches of Excel and welcome a seamless, automated workflow management system, designed specifically for your business. We have assumed the basic value of goods is $1,000 hence have charged a 10% of tax on that value, which ABC Inc will collect from XYZ Inc and pay to the government.

The Benefits of Making a Credit Sales Journal Entry

By following this process, companies can keep track of their sales and ensure that they are receiving payments in a timely manner. A credit sales journal entry is a type of accounting entry that is used to record the sale of merchandise on credit. The entry is made by debiting the Accounts Receivable and crediting the Sales account. The amount of the sale is typically recorded in the journal as well. This type of journal entry is important because it allows businesses to keep track of their sales on credit and ensures that they are properly accounted for in the financial records.

The corresponding credit is to accounts payable, a liability account. Cash, accounts receivable, and inventory are considered asset accounts, and debits always increase these accounts. On the income statement, revenues are shown to decrease with debits and increase with credits. Expenses, for example, are increased with debits and decreased with credits. Sales are a part of everyday business, they can either be made in cash or credit. In a dynamic environment, credit sales are promoted to keep up with the cutting edge competition.

In business, we may have sold goods both for cash as well as on credit during the accounting period. Likewise, we need to make the journal entry for the goods sold that may be made for cash or made on credit. Net credit sales refer to the revenues generated by selling goods on credit to customers. Additionally, net credit sales include sales returns and sales allowances.

- Net credit sales refer to the revenues generated by selling goods on credit to customers.

- Therefore, it might only have a few accounts payable and inventory journal entries each month.

- By recording each customer’s credit sales in the journal, businesses can easily see who owes them money and how much.

Having a debit balance in the Cash account is the normal balance for that account. You can see at the top is the name of the account “Cash,” as well as the assigned account number “101.” Remember, all asset accounts will start with the number 1. The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available. ‘Sold goods on credit’ is nothing but the sale of goods on a credit basis i.e. providing goods to the customer with an expectation of receiving the payment in the future. This amount owed by the debtor leads to an increase in the accounts receivables of the company and is a current asset.

On the other hand, we can make the journal entry for goods sold on credit by debiting the accounts receivable and crediting the sales revenue account. A sales credit journal entry is made when goods are sold on credit rather than for cash. In order to record a sales credit journal entry, businesses need to have an understanding of accrual accounting.